Nonprofit Bookkeeper: Key Duties, Salary & Free Job Template

Nonprofit Bookkeeper: Key Duties, Salary & Free Job Template

The vendor signs this document and confirms all details of the purchase. To learn more about purchase orders and the numberings involved, check out our post on What is a Purchase Order Number. He is registered with the IRS as an Enrolled Agent and specializes in 501(c)(3) and other tax exemption issues. The size and complexity of a nonprofit affect how often reports are needed. All of our clients are backed by a fully staffed accounting department. Learn more here about HarQuin’s consulting options and get a free bookkeeping estimate here.

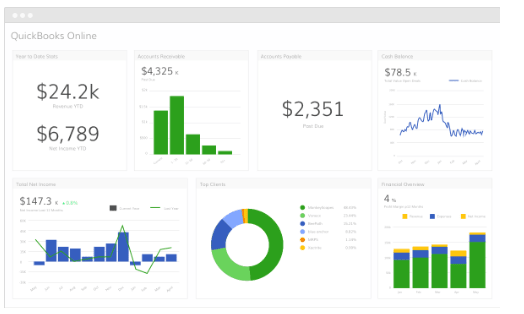

Fund accounting principles

Our clients are provided a deeply-discounted subscription to the leading, cloud-based accounting software platform available, Quickbooks Online. You’ll have secure, 24/7 access to your books and records, from anywhere you have a broadband connection. Write and print checks, sync with your bank account, generate reports…all in the same place. While an accountant will interpret financial reports and make informed suggestions for the board, a bookkeeper is responsible for organizing the nonprofit’s data to create these reports. Many accounting software programs allow you to generate financial statements automatically, such as a statement of financial position. This reduces the possibility of errors and guarantees reliability and accuracy.

Key Differences Between Nonprofit and For-Profit Bookkeeping

Next, we can take that information and provide a detailed analysis of your finances. If you have your reports and you’re ready for financial consulting, HarQuin offers consulting options to meet your unique needs. Your consultant will analyze your nonprofit’s financial information from previous years and create a financial plan, while providing actionable next steps for budgeting. You will receive estimated future projections and we can help your nonprofit come up with a plan for better allocating funds.

What Is Bookkeeping for Nonprofits?

But behind every mission lies the mathematical precision of numbers. Believe it or not, without streamlined bookkeeping, even the most ambitious can stumble and fall. What if we told you that the key to your nonprofit’s success lies not just in the heart but in the https://www.bookstime.com/ accounting ledger?

- Some cost-effective or free options are doola Bookkeeping, Wave, QuickBooks for Nonprofits and Xero.

- Some are unrestricted net assets and some are considered restricted net assets.

- Once you have your designated bank account for your nonprofit, you’ll need to ensure the financial data on your bank statement matches the data in your nonprofit bookkeeping system.

- It serves as the foundation for accurate tracking and reporting, ensuring that every transaction — whether it’s a donation, grant, or program expense — is categorized correctly.

- Explore these essential steps to nonprofit bookkeeping, from tracking donations to producing clear financial statements.

- Our nonprofit bookkeeping and accounting services are affordable and cater to every organization.

We do all the higher-level monthly closing and oversight of your books, including cost allocations, reconciliations, restricted fund adjustments, and more. We also manage your payroll, store all your receipts, file 1099s, provide monthly reports, give feedback on processes and procedures, and answer all your questions. The majority of nonprofit bookkeeper our bookkeepers have a bachelor’s degree in accounting. They are also highly trained in the specifics of nonprofit bookkeeping.

Have questions on formation, banking and taxes?

As you collect funds, pay expenses, and prepare reports, keeping these principles in mind is vital. The option you go for should also enable you to do fund accounting (i.e., use different accounts for different purposes). Nonprofits have strict rules regarding funding sources and how they should be spent.

- This routine will make it easier to manage your finances and prevent overwhelming backlogs.

- What if we told you that the key to your nonprofit’s success lies not just in the heart but in the accounting ledger?

- You must also track all invoices and payments paid by your organization.

- Use your past records to strategize ways to continuously improve your organization’s fundraising and service delivery.

- A generous car dealership gives you a vehicle for free, but that doesn’t mean it wasn’t a transaction!

- The roles of a treasurer and a bookkeeper are distinct yet interdependent.

Core Nonprofit Bookkeeping Duties

- This approach helps you allocate funds efficiently and prepare for future needs.

- Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go—auto-import receipts from Gmail.

- Both for-profit and nonprofit organizations usually comply with generally accepted accounting principles (GAAP).

- It has a nonprofit software that allows organizations to invoice, track donations, develop reports, and more.

- Many nonprofits start as smaller organizations with one or two people.

Learning how to do nonprofit accounting and understanding which statements a nonprofit needs to prepare is crucial for anyone who wants to run a successful nonprofit. These financial statements can provide helpful insight into your nonprofit’s financial health so that you can adjust accordingly and plan your next moves. Think about your budget like a roadmap to where you’ll spend your money. You have to know the area to plan a route, and the same can be said about your nonprofit’s budget. Accurate and timely bookkeeping practices will make the job of those tasked with budgeting much easier to tackle. By managing daily transactions, processing payroll, and assisting with budgeting, bookkeepers allow leadership to focus on strategic growth and mission fulfillment.

Donations are the lifeblood of most nonprofits, and tracking them accurately is critical for maintaining trust with donors and compliance with tax laws. You need to ensure that donations https://www.facebook.com/BooksTimeInc/ — whether cash, in-kind, or grants — are properly recorded, especially when there are restrictions on how the funds can be used. Now that you have chosen the right bookkeeping software, it’s time to organize your finances through a Chart of Accounts (COA).

- As mentioned, nonprofit organizations have tax-exempt status, meaning they don’t have to pay federal taxes to the IRS under Section 501.

- It’s intuitive and easy to use, making it ideal for small nonprofits.

- As with most decision-making processes at your nonprofit, financial management is most effective when it’s data-driven.

- Bookkeeping for nonprofits is recording and analyzing financial transactions to ensure compliance with state and federal accounting rules.

- A nonprofit must operate on an annual budget that includes all income sources and expenses.

- Like for-profits, nonprofits need a sound and accurate bookkeeping system to bring value to our communities.

It’s perfect for organizations that need reliable assistance without the hefty price tag. By understanding these basics, you’ll be better equipped to manage your nonprofit’s bookkeeping effectively, even on a tight budget. Understanding the basics of nonprofit bookkeeping is essential for managing your organization’s finances effectively. Nonprofits often operate on tight budgets, making it challenging to maintain accurate and transparent financial records. Limited resources can lead to errors, missed deadlines, and compliance issues, which can jeopardize funding and support. Not only is nonprofit bookkeeping different from its for-profit counterpart, but a bookkeeper is just one of the professionals you should have working on your organization’s finances.