How foreigners will get a home loan within the Southern Africa

How foreigners will get a home loan within the Southern Africa

Blog post bottom line

- Foreign people or nonresidents normally invest in property into the Southern Africa once the anyone, otherwise through-joint possession otherwise by the acquiring offers in an organization you to definitely has property.

- Nonresidents must transfer fifty% of your own purchase price or balance out of price through the Set-aside Lender, off their own international bank to a designated membership (that usually be the trust account of your mobile attorney) having an authorized Southern area African lender.

- All of the foreigners, specifically nonresidents, must purchase one to rand in the united kingdom for every rand they need obtain. Extent people from other countries otherwise nonresidents is also acquire is restricted so you’re able to 50% of one’s price.

The newest Southern area African possessions market is still a prime interest to own foreign dealers, owing to a favorable exchange rate and you may loads of deluxe property for the beautiful towns and cities. Overseas capital is expected to advance boost once the savings slowly recovers about Covid lockdowns.

What things to realize about mortgage brokers to possess foreign people in the South Africa

People from other countries not resident inside the Southern area Africa, who will be keen buying property here, does so physically otherwise as you, or of the acquiring offers for the a family that is the joined proprietor away from a house.

step one. If you buy possessions owing to an estate agent, they must be a registered member of the brand new Home Service Activities Board which have a valid Fidelity Financing Certification.

2. Once you make an offer to find and is also accepted, a binding agreement of revenue is drawn up into client, provider as well as 2 witnesses so you can indication. That it contract is actually legally joining. If sometimes the consumer or merchant cancels the latest agreement in the 11th hours, they can be charged to own expenses incurred, instance wasted court costs.

step 3. The give to get together with arrangement off business demands becoming realized prior to he could be closed and you may filed. It is best to search independent legal advice when the some thing is actually unsure.

4. Possessions within the Southern Africa comes voetstoets (as it is). Although not, the customer should be informed of all the patent and you will hidden faults on property.

5. Accessories and you can fittings was immediately included in the sales of your assets. For clearness, these can be placed in the new contract of purchases.

six. Electric and you will beetle certificates must concur that brand new electric installment is compliant which have statutory requirements and therefore the house try not infested because of the particular beetles. (The second certification might be simply mandatory within the coastal countries.) Some countries want plumbing work and energy permits.

seven. Every foreigners not resident otherwise domiciled inside the Southern area Africa need certainly to purchase that rand in the nation per rand they have to use. Extent people from other countries or non-residents can be use is limited in order to 50% of your own cost. Acceptance will be required of the exchange handle bodies, which will confidence having the ability to personal installment loans in Eagle prove the new inclusion so you can South Africa regarding a cost comparable to the bond loan amount.

8. Banking companies simply financing 50% of your own get worth of the home getting nonresidents. Thus international buyers usually possibly need promote a good 50% deposit, or pay bucks and you can expose the full matter on South Africa via the Reserve Lender to a selected checking account (which will constantly become trust membership of moving attorney) which have an authorized Southern area African lender.

nine. The brand new listing of one’s put of your funds obtained out-of a great international origin is known as a great price receipt and may end up being chosen because of the buyer because it’s requisite toward repatriation out of loans if house is in the course of time ended up selling.

ten. In case it is a joint app, one candidate need certainly to secure no less than R25 one hundred thousand monthly, end up being 18 ages otherwise old and possess a definite credit score.

What records am i going to you want whenever obtaining a home loan given that a foreign buyer?

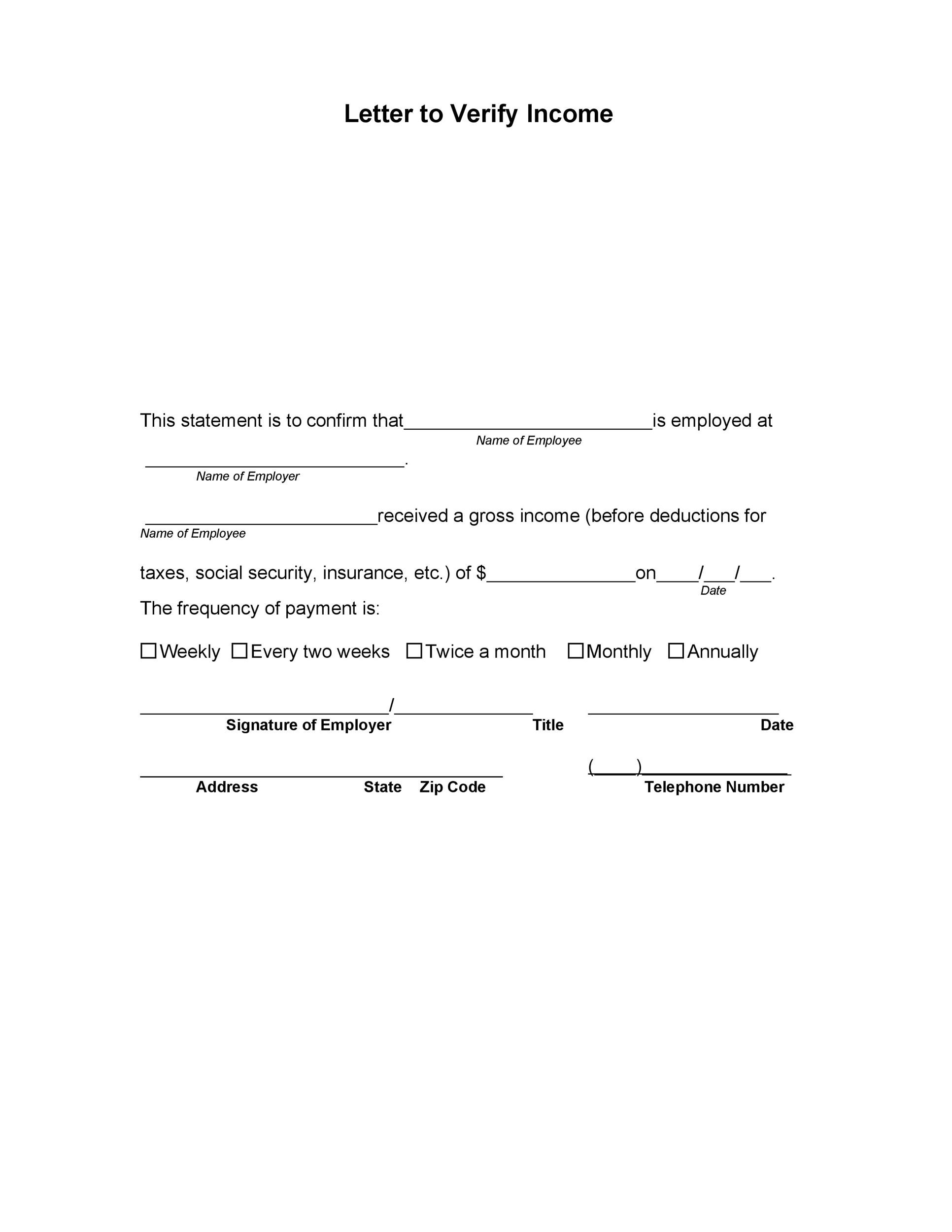

- A customer Financial Interview Setting, signed and you can dated. As an alternative you can over an internet app that have ooba Lenders:

- A copy of one’s ID otherwise each party from a keen ID Cards Otherwise a different otherwise South African passport Or a work enable enabling you to functions overseas.

- A paycheck Information Or an effective payslip on the newest 6 months (up to submitting time).

- A duplicate regarding the full Package out of A career.

- A person Financial Interview Means, finalized and you may dated. Instead you can done an on-line application that have ooba Mortgage brokers:

Trying to get home financing thanks to a south African bank

ooba Lenders was Southern area Africa’s premier financial comparison solution, and certainly will help foreign people buying possessions within the South Africa after they sign up for a thread as a consequence of a-south African standard bank.

Audience dont necessarily must discover a banking account with that industrial lender, as they possibly can transfer fund straight from their overseas membership on their residence financing account.

We could submit your application to several Southern area African banking institutions, enabling you to compare bundles and get the best package toward your residence mortgage.

I also offer a selection of products that make the property process easier. Start by all of our Thread Calculator, then fool around with our Bond Sign to determine what you really can afford. In the long run, before you go, you could submit an application for a mortgage.