Cost-Volume-Profit CVP Analysis- Explained With Examples

Cost-Volume-Profit CVP Analysis- Explained With Examples

It’s used to calculate the break-even point in sales units or sales dollars, and to understand the relationship between costs (both variable and fixed costs), sales volume, and profit. Alternatively, if the selling price per unit increases from $25 to $30 per unit, both operating income and the contribution margin ratio increase as well. When the variable costs of production increase, there’s a direct impact on a business’s profitability, especially if it can’t immediately adjust its price levels.

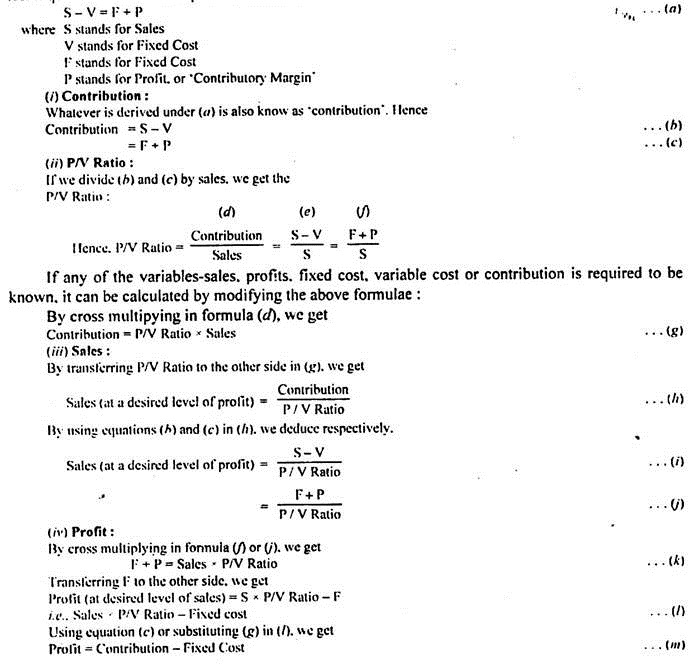

Cost-Volume-Profit (CVP) Analysis Formula

Managers can use this information to identify areas where costs can be reduced, thereby improving profitability. Despite Cost-volume-profit (CVP) analysis’s usefulness, it has some limitations that businesses must consider before taxable income relying solely on it to make strategic decisions. In fact, CVP analysis can help businesses make accurate forecasts for future sales and expenses, enabling them to budget and plan for the long-term operations of their business.

Setting a Dollar Target For Breaking Even

Organizations should update their forecasts, sales mix, and cost structures to determine the profitability of their operations. Continual monitoring and analysis of CVP ensure that organizations stay on track to achieve their financial and operational goals. CVP analysis helps companies to identify the best product mix that maximizes their profits. Through CVP analysis, businesses can evaluate the contribution margins of each product and allocate their resources accordingly, focusing on products with higher contribution margins.

What types of costs are included in CVP Analysis?

It can, therefore, say with some degree of certainty that the contribution per unit (sales price less variable costs) is $20. Company A may also have fixed costs of $200,000 per annum, which again, are fairly easy to predict. However, when we ask the question, ‘Will the company make a profit in that year? However, we can work out how many sales the business needs to achieve in order to make a profit and this is where CVP analysis begins. This analysis informs the decision on whether the market expansion is likely to be profitable and assists in setting sales targets.

- This helps in understanding the breakeven points over the long term and in assessing the viability of the expansion strategy.

- Essentially, businesses can plan their sales budget more accurately by understanding how changes in sales volume impact profits.

- These could also be drawn for a company selling multiple products, such as Company A in our example.

- The contribution margin is the difference between total sales and total variable costs.

To get the answer in dollars, divide fixed costs by the contribution margin ratio. This includes challenges for CVP analysts when identifying what should be considered a fixed cost and what should be classified as a variable cost. CVP is a comprehensive analysis that examines the relationship between sales volume, costs, and profit to determine break-even points and profit targets.

It’s a clear and visual way to tell your company’s story and the effects when changing selling prices, costs, and volume. In CVP analysis, the aspects of risk and uncertainty are often overlooked. The assumptions of constant sales prices, linear cost behaviors, and certain volumes, all dismiss the inherent uncertainties present in most business environments. For any business dealing with multiple products, the application of cost volume profit analysis requires a more nuanced approach.

On a contribution margin income statement, costs are classified as variable or fixed. The contribution margin per unit is calculated by subtracting the variable cost per unit from the selling price per unit. However, we will likely need to enter a sales dollar figure (rather than the number of units sold) on the register. A cost-volume-profit chart is agraph that shows the relationships among sales, costs, volume, andprofit. The illustration shows acost-volume-profit chart for Video Productions, a company thatproduces DVDs.

The contribution margin ratio and the variable expense ratio can help you evaluate your company’s profitability with respect to variable expenses. The contribution margin can be calculated to get a total dollar amount or an amount per unit. To get a total dollar amount, subtract the total variable costs from the total sales amount. Lastly, cost volume profit analysis can facilitate the formulation of a cash flow budget. Knowledge of profit levels at various volumes can help predict the cash flow, chiefly inflow from sales revenue and outflow from expenses.

Incorporating CVP analysis into scenario planning and sensitivity analysis significantly enhances long-term financial planning. This involves projecting how changes in sales volume, costs, and prices affect profitability over an extended period. Cost volume profit analysis can be used to justify embarking on manufacturing a new product or providing a new service. By analyzing fixed and variable costs separately, CVP analysis provides insight into the profitability of different products and services, allowing you to make smarter decisions.