When to and you will Shouldnt Become Refinancing Doctor Financing

When to and you will Shouldnt Become Refinancing Doctor Financing

Their entry to medical practitioner mortgages was a significant investment due to the fact a physician. Besides can it make it easier to when buying a property, but it also provides the monthly obligations as little as you’ll. However when rates on a doctor mortgage shed, you’re searching for refinancing. Continue reading this short article to learn about your refinancing options and medical practitioner loan pricing.

Was Refinancing Physician Money You are able to?

Sure, same as a normal loan, you might re-finance physician financing as a result of a home loan company. But just as you may re-finance your physician home mortgage will not suggest you always is always to. Particular people believe that when medical practitioner financing rates of interest drop, they should jump in the possibility. But based your unique products, it’s also possible to in fact save your self extra money in the end in the event that your stick with your higher level.

Whenever Any time you Consider Refinancing Medical practitioner Money?

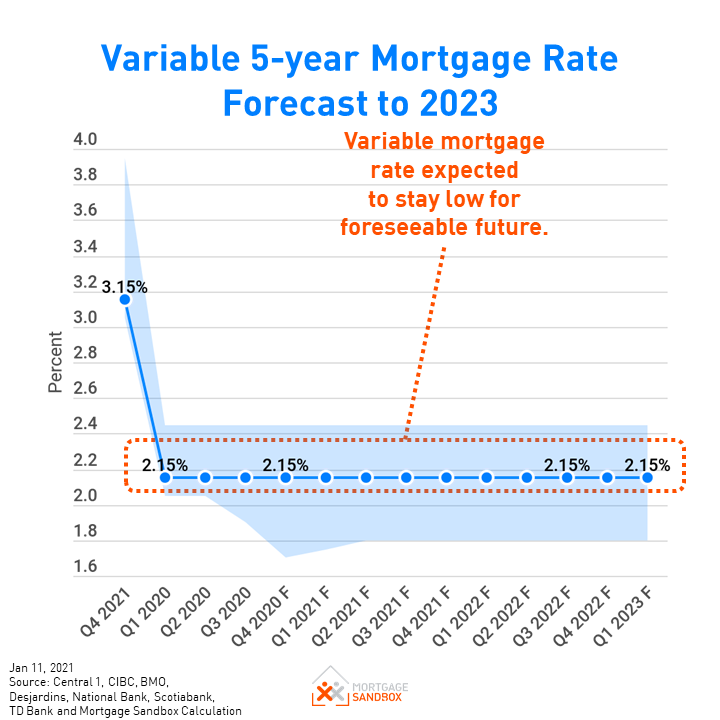

The biggest reason why many people refinance the funds occurs when loan providers lower interest levels to your medical practitioner funds. Along the longevity of financing, interest rates go up and down. Assuming medical practitioner mortgage cost drop, the reduced monthly obligations may seem enticing.

Keep this rule of thumb planned, in the event, when refinancing medical practitioner fund and you may old-fashioned mortgages: You ought to hold back until the pricing miss no less than a complete fee section. If the doctor financing costs fall, however, only by the fractions out-of a per cent, it might not getting a payment-active substitute for decreasing mortgage costs. That’s because discover costs associated with the refinancing medical practitioner loans.

Most of the go out, refinancing will set you back thousands of dollars upfront. The point in time when the overall money you save into monthly premiums translates to the total amount you invested refinancing your loan was known as crack-also area. Experts recommend refinancing physician finance if the crack-even part is in less than six many years. So if you you should never plan to stay in your current domestic for a lengthy period going to the vacation-actually point, refinancing may possibly not be in your best interest.

An alternative time for you to thought refinancing is when you can switch from an adjustable price so you can a lower repaired interest to the physician financing. Locking from inside the a smooth medical practitioner loan rate of interest without having to worry in the they ascending in the couple of years may help your own a lot of time-title cost management and help you reach the break-even point in less time physical stature.

Was Physician Mortgage Cost similar to Traditional Financial Rates?

When it comes time to possess refinancing doctor funds, we would like to find the all the way down rate of interest it is possible to. In most facts, mortgage loans to possess doctors are a bit greater than those offered with traditional financing. Since you end personal home loan insurance policies (PMI) and commonly needed to put the common amount down, if any bucks after all, for buying a home, lenders restriction their chance.

Physician loan interest levels are usually .25% so you can .5% greater than standard home loan costs. When you find yourself that perhaps not appear to be a big difference at first glance, it can be the real difference within the tens and thousands of cash spent over the lifetime of a loan.

As with any fund, doctor financing prices change every day. If you are earnestly after the idea of refinancing a health care provider financing, it’s important to closely screen pricing to make certain you are doing thus at only suitable big date.

If you’re looking to your refinancing a physician mortgage, get in touch with Doctor’s Capital Properties. Our team out-of pros can help you which have searching for and you will securing the best mortgage rate for your problem.

How come Refinancing Doctor Money Grounds Towards Overall Financial Considered?

A low-value interest on the a physician mortgage increases the number of money you retain easily accessible. Early in your scientific career, the greater amount of you might place into paying education loan debt on your top residence, the earlier you could start building a solid personal monetary ground.

Partnering having an economic planning professional one focuses on building riches and securing the newest economic protection out of doctors makes sure you are getting yourself into much time-identity achievement. While you focus on a monetary coordinator getting refinancing an effective doctor mortgage, capable line up your brand-new mortgage along with your short- and you may much time-title objectives. . Refinancing physician loans is among the various ways you can be make more funds circulate to possess savings and expenditures. One of several regions of your finances a coach can assist having are:

Personalized Economic Methods

Active money management is just one of the best ways to sense financial victory. A financial coach works together with you to learn the enough time-name requirements and you will grows a decide to arrive at all of them. Using a personal debt government program, your advising lover can create a risk character so you obviously understand any hurdles and can bundle consequently.

Dealing with Threats and you will Undesired Effects

While the a health care provider, you know problems, injury, and accidental or unanticipated death may appear anytime. The same may appear which have an economically disastrous malpractice claim. That have a reliable advisor by your side in order to plan for this type of unfortunate situations helps you prevent the monetary problems of these.

Are you Contemplating Refinancing a health care provider Loan? Healthcare provider’s Financial support Services Is here now to greatly help

Refinancing is mostly about over reducing the rate of interest into an excellent physician loan. This means with way more economic versatility to acquire your next, pay Pine Brook Hill loan places off education loan expense, and set yourself up for a comfortable advancing years. Within Physician Investment Characteristics, i concentrate on permitting residents, fellows, and practicing physicians started to the financial requirements in a number of ways.

Contact the brand new PSR group right now to agenda an appointment and begin discussing the procedure of refinancing medical practitioner loans or any other monetary strategies.