Definition, Explanation and Examples

Definition, Explanation and Examples

An error in transaction analysis could result in incorrect financial statements. Assets entail probable future economic benefits to the owner. Anushka will record revenue (income) of $400 for the sale made. A trade receivable (asset) will be recorded to represent Anushka’s right to receive $400 of cash from the customer in the future.

- It can be found on a balance sheet and is one of the most important metrics for analysts to assess the financial health of a company.

- For instance, if a business takes a loan from a bank, the borrowed money will be reflected in its balance sheet as both an increase in the company’s assets and an increase in its loan liability.

- The accounting equation is based on the premise that the sum of a company’s assets is equal to its total liabilities and shareholders’ equity.

- The difference between the sale price and the cost of merchandise is the profit of the business that would increase the owner’s equity by $1,000 (6,000 – $5,000).

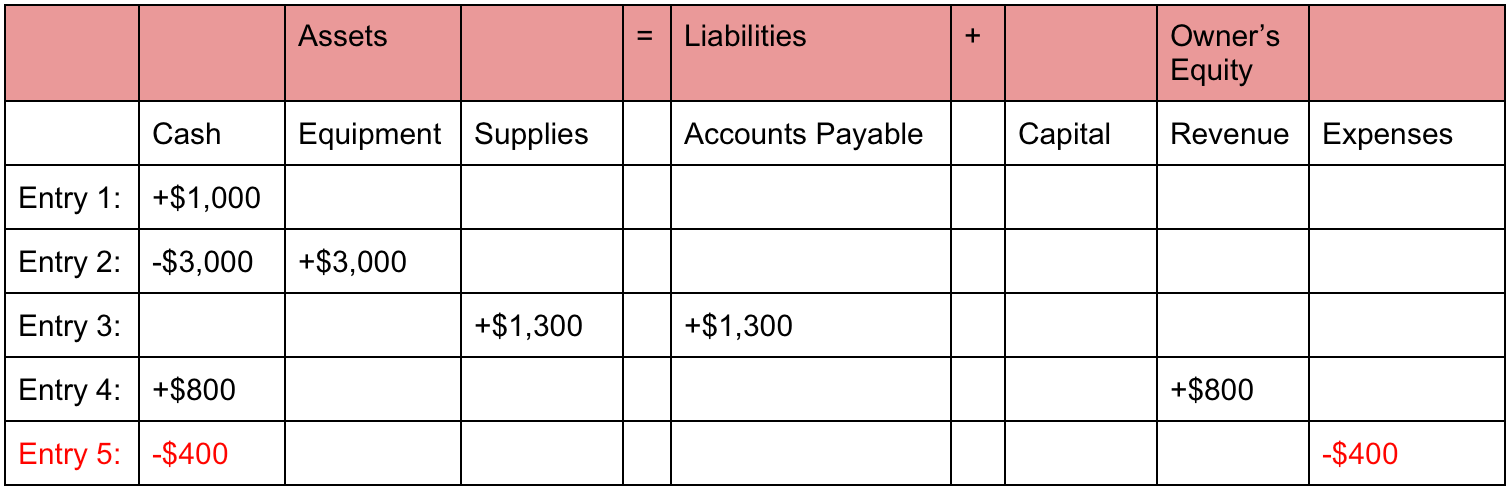

- To illustrate how the accounting equation works, let us analyze the transactions of a fictitious corporation, First Shop, Inc.

Effect of Transactions on the Accounting Equation

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

Purchase of Equipment in Cash

Alternatively, Edelweiss may be facing business risks or pending litigation that could limit its value. Consideration should be given to these important non-financial statement valuation issues if contemplating purchasing an investment in Edelweiss stock. This observation tells us that accounting statements are important in investment and credit decisions, but they are not the sole source of information for making investment and credit decisions. Income and expenses relate to the entity’s financial performance.

Owners’ Equity

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The merchandise would decrease by $5,500 and owner’s equity would also decrease by the same amount. On 22 January, Sam Enterprises pays $9,500 cash to creditors and receives a cash discount of $500. On 1 January 2016, Sam started a trading business called Sam Enterprises with an initial investment of $100,000.

On 12 January, Sam Enterprises pays $10,000 cash to its accounts payable. This transaction would reduce an asset (cash) and a liability (accounts payable). At this point, let’s consider another example and see how various transactions affect the amounts of the elements in the accounting equation. If an accounting equation does not balance, it means that the accounting transactions are not properly recorded. Owners can increase their ownership share by contributing money to the company or decrease equity by withdrawing company funds.

In other words, the total amount of all assets will always equal the sum of liabilities and shareholders’ equity. To illustrate how the accounting equation works, let us analyze the transactions of a fictitious corporation, First Shop, Inc. They include items such as land, buildings, equipment, and accounts receivable.

Likewise, revenues increase equity while expenses decrease equity. When a company purchases goods or services from other companies on credit, a payable is recorded to show that the company promises to pay the other companies for their assets. A liability, in its simplest terms, is an amount of money owed to another person or organization. Said a different way, liabilities are creditors’ claims on company assets because this is the amount of assets creditors would own if the company liquidated. Now that we have a basic understanding of the equation, let’s take a look at each accounting equation component starting with the assets.

Owner’s or stockholders’ equity also reports the amounts invested into the company by the owners plus the cumulative net income of the company that has not been withdrawn or distributed to the owners. Shareholders’ equity is the total value trial balance explained: your complete guide of the company expressed in dollars. Put another way, it is the amount that would remain if the company liquidated all of its assets and paid off all of its debts. The remainder is the shareholders’ equity, which would be returned to them.

The effects of changes in the items of the equation can be shown by the use of + or – signs placed against the affected items.